Traditional staking, which Typically involves buyers to lock up tokens for a particular length, differs from liquid staking, wherever members can stake their assets while trying to keep them liquid.

Liquid staking is changing staking as we understand it currently, by including liquidity, flexibility, and maximization of return for people. Liquid staking bridges traditional staking with DeFi ecosystem by enabling the customers to stake their assets and earn reward on them while carrying out other money routines.

Being informed on regional laws is very important. Remaining updated to the regulatory atmosphere is important to be sure compliance and control challenges correctly.

Liquid staking, on the other hand, presents a mechanism to keep the assets Energetic and liquid, even while they are being staked. By obtaining a derivative token, people can freely trade or use their staked assets throughout several DeFi platforms.

Critical reward: Puffer Finance drastically lowers the entry barrier for Ethereum staking while maintaining the safety great things about classic validation.

StakeWise: StakeWise gives liquid staking for Ethereum with sETH2 tokens, featuring a twin-token model to individual staking rewards

Liquid staking lets end users to earn staking rewards while also owning the ability to use their money in other financial investment strategies. This adaptability enhances the Over-all return on financial investment (ROI) by enabling consumers to concurrently earn staking rewards and be involved in other generate-making things to do.

8% APY to stakers. Users who Liquid Staking Enables Ethereum Holders To Earn Staking Rewards While Maintaining Asset Liquidity deposit Eth towards the protocol acquire stETH, the protocol’s liquid staking derivative. Lido staked Ether is the largest LST by industry dimension In keeping with knowledge from Coingecko. stETH is supported on many DeFi platforms and can be utilized in generate-farming applications or traded on exchanges. stETH is likewise supported on numerous liquid restaking protocols.

Slashing — the penalty for validator misbehavior — is a big hazard in Proof of Stake validation. Puffer Finance has created Innovative protection in opposition to this threat.

BTC staking and liquid staking: Solv protocol enables BTC holders to pursue authentic yield and expanded financial options applying their assets.

Sooner or later, we could see all the more attention-grabbing apps and developments With this area. Possessing stated this, it is vital to comprehend the basics of both concepts and the way to utilize them.

Tokens staked within a community for instance Ethereum are locked and cannot be traded or applied as collateral. Liquid staking tokens unlock the inherent benefit that staked tokens maintain and help them being traded and utilised as collateral in DeFi protocols.

For example, a consumer could deposit ETH to your Lido staking pool and get stETH (staked ETH) tokens in return, then deposit the stETH to Aave to earn generate. Fundamentally, liquid staking builds on existing staking devices by unlocking liquidity for staked tokens.

Liquid staking empowers token holders to earn staking rewards devoid of dropping access to their assets for investing or lending. Individuals earn dependable staking rewards while benefiting from additional alternatives in decentralized finance.

Rider Strong Then & Now!

Rider Strong Then & Now! Dylan and Cole Sprouse Then & Now!

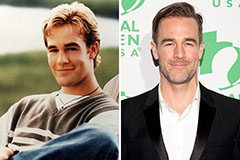

Dylan and Cole Sprouse Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Lucy Lawless Then & Now!

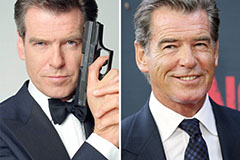

Lucy Lawless Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!